Not Sure Where To Begin?

Use our Advisory Framework to explore the area most relevant to your business

Exploring funding or working capital

Curious about tax credits or savings

Concerned about payroll costs

Unsure what applies

Swift Funding Solutions

TBA.

Accelerate Your Business Growth

Take a Look

Our Main Line Up

More

Partial Ancillary Line Up

Here is a partial line-up of areas we can find value in

Revenue Based Financing solutions

We specialize in providing revenue-based working capital to small businesses, enabling them to meet their short-term financial needs and seize growth opportunities. We understand that traditional financing options may not always be accessible or suitable for small businesses, which is why we offer this alternative funding solution.

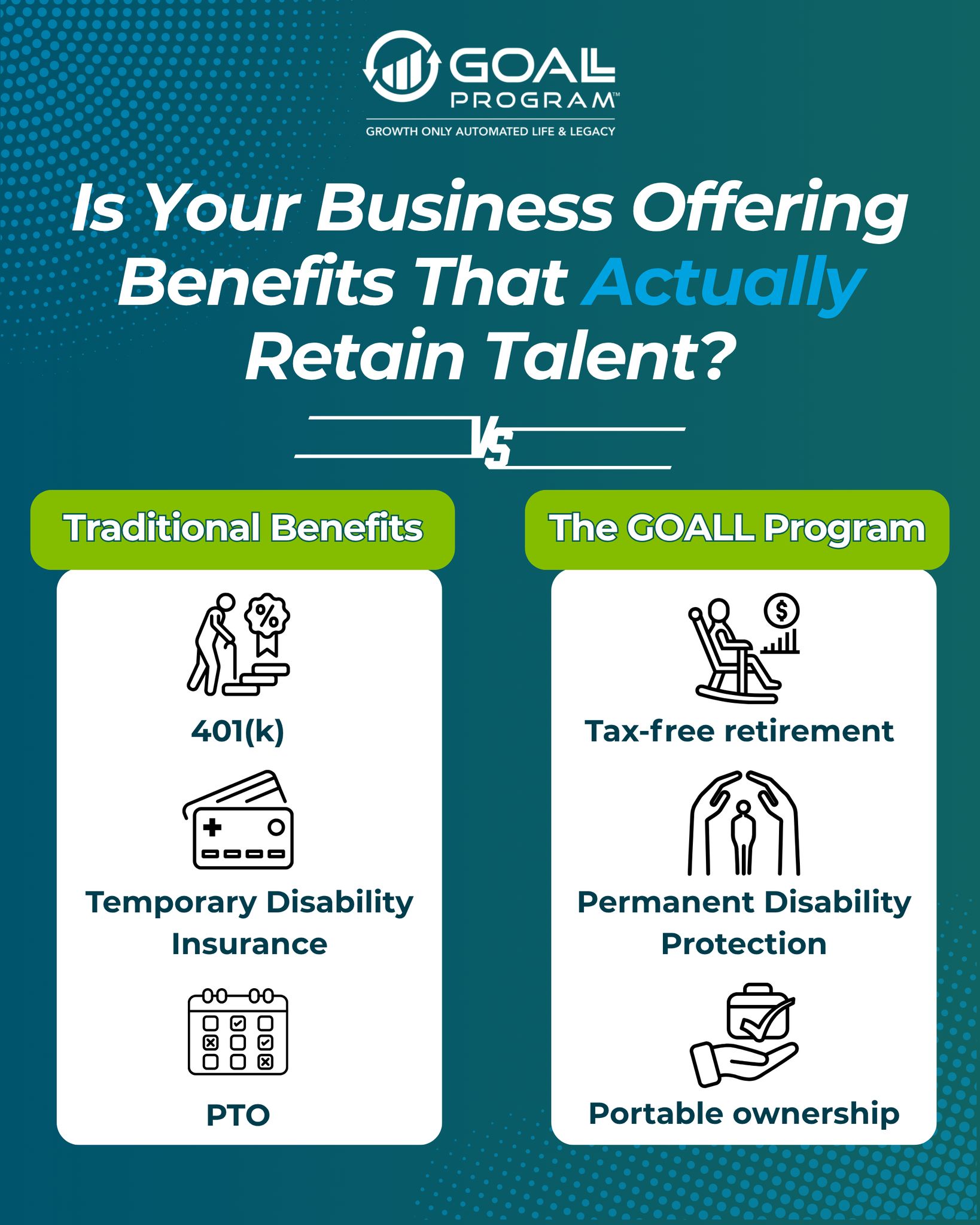

Boost Your Team with Premium Benefits

At GOALL (Growth Only Automated Life & Legacy) we create a true win-win by solving employer challenges with solutions that fulfill employee wants. GOALL helps employers attract and retain top talent by offering benefits that protect employees from market, income, health, legislative, and tax risks—during their careers and into retirement. This approach strengthens company culture, boosts loyalty, improves recruitment and retention, and lowers benefit costs. By aligning employee desires with employer goals, GOALL helps businesses stand out and grow profitability.

Technology Solutions

Through our partnership with Dreams Business Resources, businesses gain access to a broad range of vendor-neutral technology solutions designed to support operational efficiency, security, scalability, and long-term growth. These services span areas such as cloud infrastructure, cybersecurity, managed IT services, connectivity, mobility, IoT, and emerging AI-enabled capabilities, all delivered through a single advisory point of contact that helps organizations assess needs, compare options, and align technology investments with business objectives—without being locked into any single provider or product.

Visit Our Partners

Explore and gain Unique Program Access from these partners

How

How AlanDavid.us Helps Businesses Choose the Right Solutions

Not a Bank. Not a Lender. Not a One-Product Pitch.

Most platforms push applications.

We help you evaluate options first.

AlanDavid.us works as an advisor-first resource, guiding business owners through funding, tax, and operational strategies so they can choose solutions that actually fit their business model.

Why Business Owners Get Stuck

Many businesses don’t fail due to lack of options — they fail due to poor fit.

Business owners often face:

- Applying for funding that strains cash flow

- Taking loans when tax credits could have freed capital

- Choosing speed over structure

- Being sold a product instead of being advised

The problem isn’t access.

The problem is knowing what makes sense before committing.

How We Help Businesses Evaluate Their Options

We help business owners understand and compare solutions such as:

- Non-Bank Business Funding

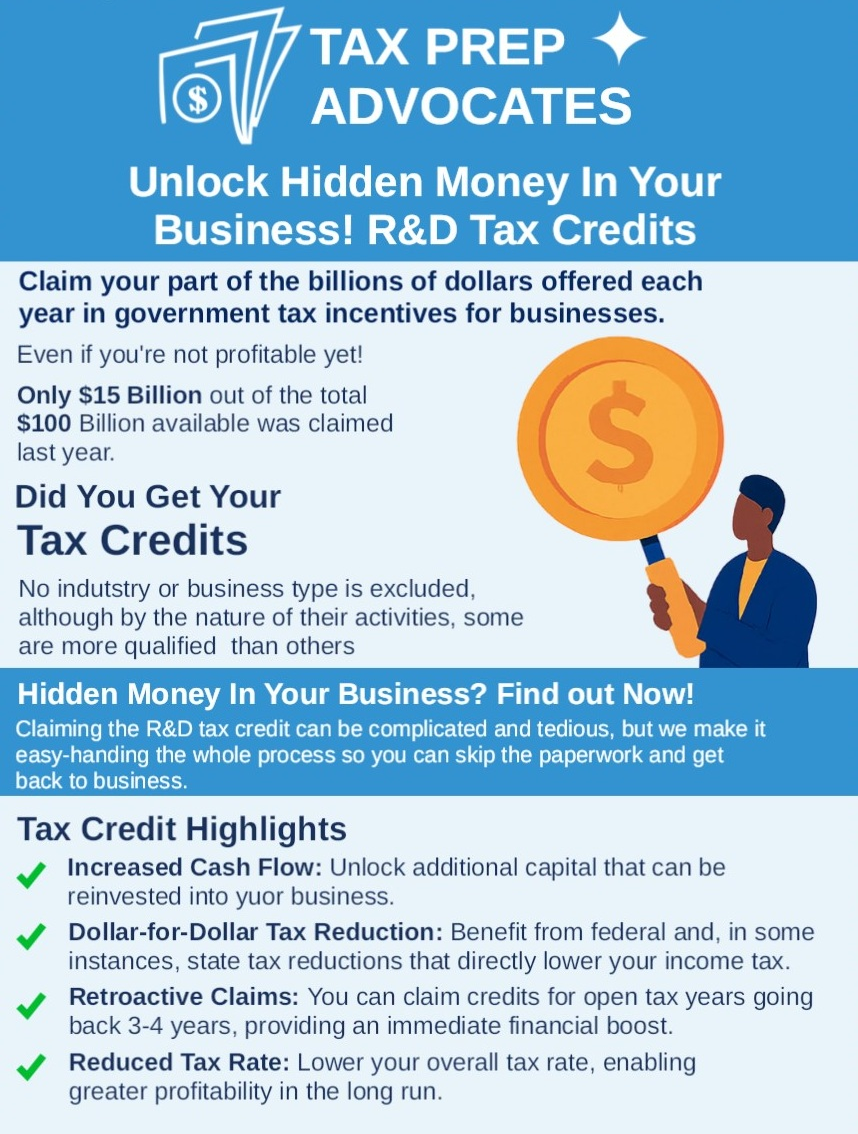

Revenue-based financing and working capital alternatives designed around cash flow, not rigid payments. - Tax Credit & Tax Strategy Opportunities

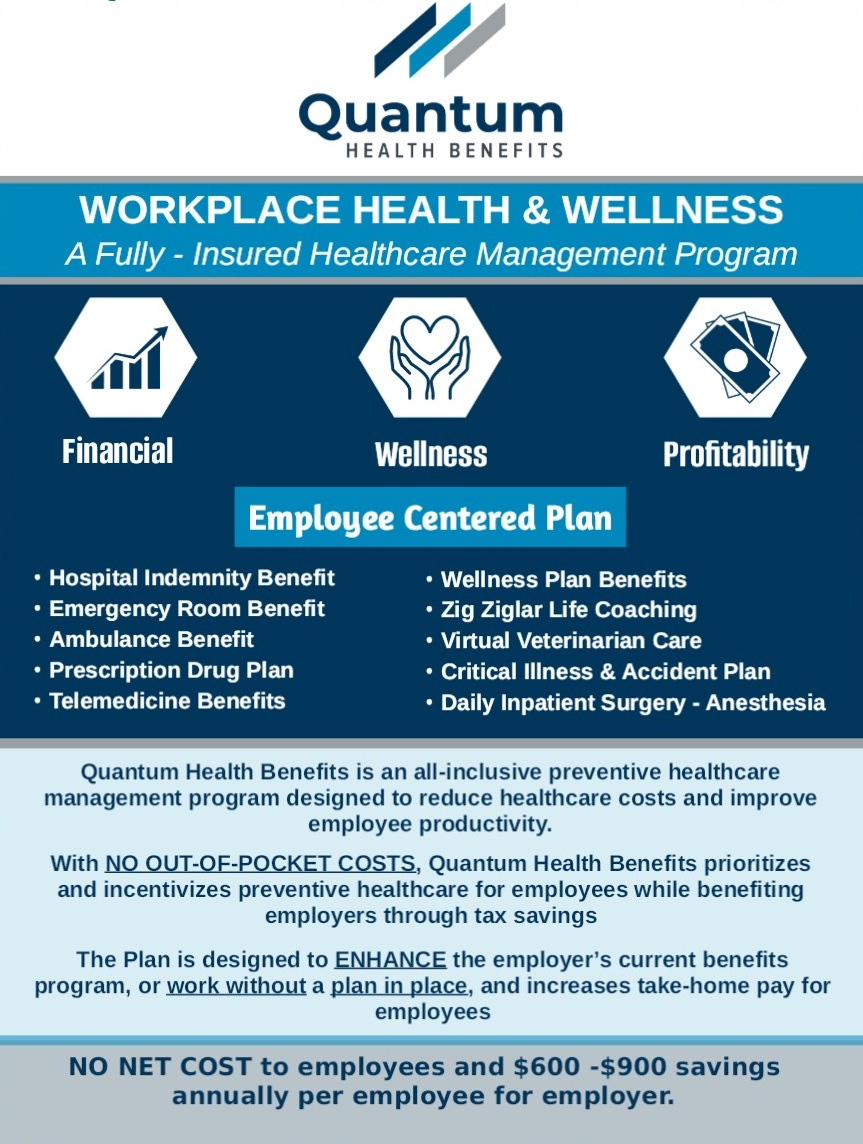

Including R&D tax credits and payroll-related strategies that may reduce tax burden and improve cash position. - Cash Flow & Payroll Optimization

Solutions that improve liquidity without increasing debt. - Solution Sequencing & Fit Analysis

Determining what to use first — and what to avoid — based on revenue, industry, and growth goals.

We don’t sell one answer.

We help you choose the right one.

Why Businesses Use Advisory Platforms Before Applying

Applying blindly to lenders or programs can:

- Trigger unnecessary credit checks

- Lock businesses into poor terms

- Waste time on solutions that don’t fit

That’s why many business owners work with independent advisory platforms that focus on education, evaluation, and fit.

Rather than offering a single product, AlanDavid.us helps businesses compare funding and tax strategies, then connect with appropriate providers only after the right approach is clear.

Who AlanDavid.us Is Designed For

This platform is built for:

- U.S. small and mid-sized business owners

- Founders and operators seeking capital or tax relief

- Companies exploring alternatives to traditional bank loans

- Businesses that want guidance — not pressure

If you want to understand your options before applying, you’re in the right place.

Our 3-Step Advisory Approach

1. Understand Your Situation

We look at revenue, cash flow, goals, and constraints.

2. Compare Viable Solutions

Funding, tax credits, payroll strategies, or combinations — explained clearly.

3. Move Forward with Confidence

Once the fit is clear, you can pursue solutions aligned with your business.

No guessing. No unnecessary applications. No pressure.

How This Is Different from Lenders and Marketplaces

- We don’t push applications

- We don’t represent a single product

- We don’t sell speed over structure

- We focus on decision clarity first

- Start with Understanding — Not an Application

- The best funding or tax solution depends on your business, not a headline rate or approval speed.

- If you want clarity before committing, start here.

- Get a Free Business Solutions Overview

AlanDavid.us is an independent business advisory resource — not a lender, broker, or service provider.

Rather than offering a single product, the platform helps business owners evaluate funding, payroll, and tax considerations — including revenue-based financing, working capital alternatives, payroll tax optimization, and tax credits — before engaging with any third-party solution.AlanDavid.us does not provide loans, insurance, tax preparation, legal services, investment advice, or trading recommendations.

When appropriate, AlanDavid.us may introduce business owners or professionals to licensed or specialized providers based on fit and context, not sales quotas or underwriting authority.

Articles

Let’s Checkout Our All Latest News

Why Choose Us

FAQ’s

Frequently Asked Questions

AlanDavid.us is an advisory-first business growth platform that helps U.S. business owners understand funding, tax strategy awareness, payroll optimization, and growth options before committing to any product or service.

Is AlanDavid.us a lender, CPA firm, or insurance provider?

No. AlanDavid.us is not a lender, bank, CPA firm, law firm, or benefits administrator. We provide education, assessments, and guidance, then connect businesses to vetted third-party specialists when appropriate.

How do you decide which solutions to recommend?

Recommendations are based on assessment results, business context, timing, and suitability — not on selling a specific product. In many cases, the recommendation is to delay action or pursue a different priority first.

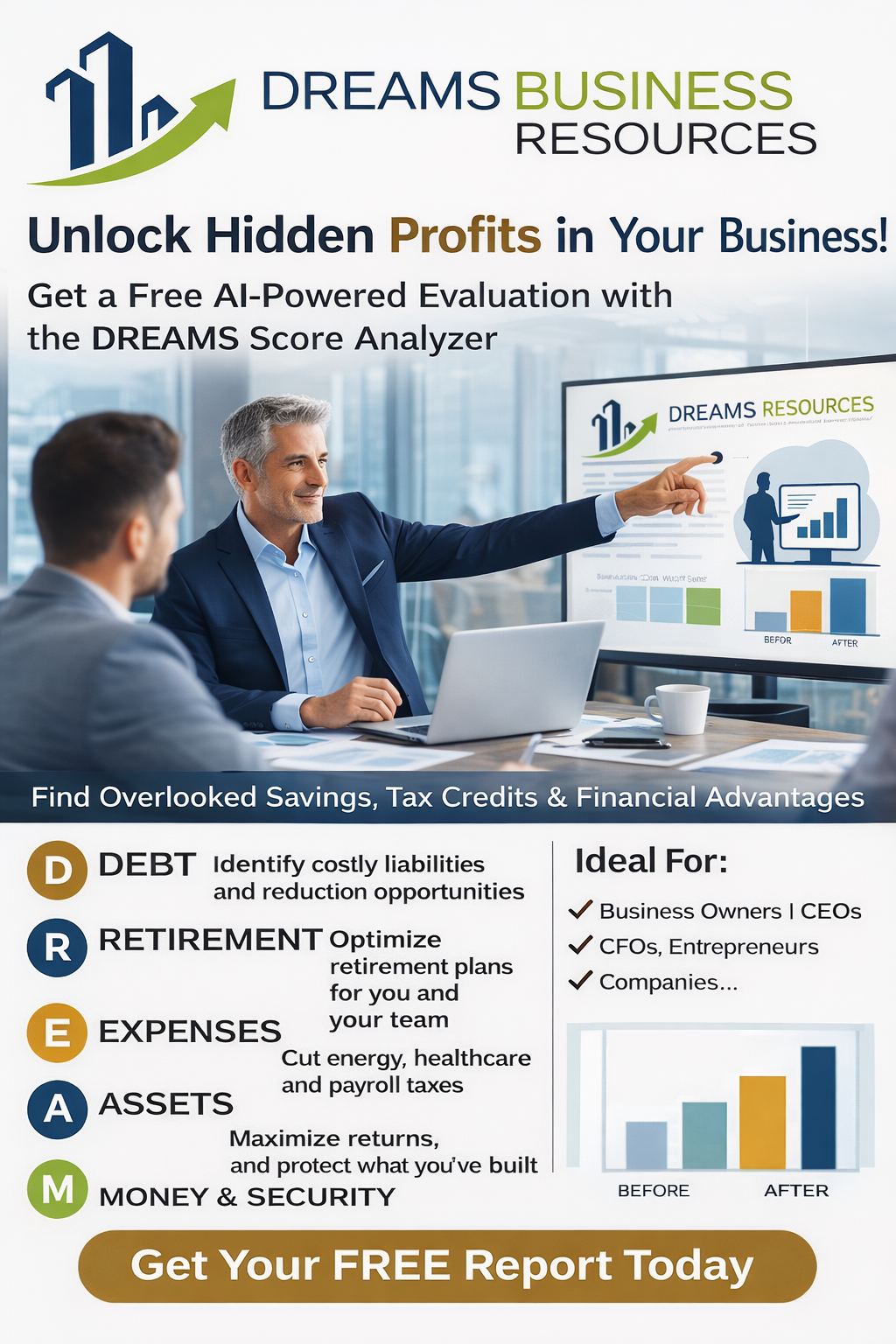

What is the DREAMS Score assessment?

The DREAMS Score is a complimentary business assessment designed to identify potential opportunities related to capital access, tax credits, payroll optimization, operational efficiency, and growth priorities. It is a diagnostic starting point, not a sales pitch.

Is the assessment really free and obligation-free?

Yes. The assessment is complimentary and there is no obligation to purchase any service. Businesses decide whether or not to proceed after reviewing their results.

Does AlanDavid.us receive compensation from partners?

Yes. AlanDavid.us participates in affiliate and referral relationships and may receive compensation if a partner service is engaged. This compensation does not increase client costs and does not influence recommendations.

Who is this platform best suited for?

AlanDavid.us is designed for U.S.-based small business owners, entrepreneurs, and employers who want clarity and informed decision-making — not high-pressure sales tactics.

Q: Is AlanDavid.us related to the custom clothing brand Alan David?

A: No. AlanDavid.us is an independent business advisory platform focused on funding, tax, and cash-flow solutions. It is not related to any apparel, tailoring, or custom clothing businesses with a similar name.

For Professionals: Expand Your Advisory Capabilities

A structured pathway for CPAs, attorneys, insurance agents, and advisors to broaden the solutions they can responsibly discuss with business clients.

AlanDavid.us collaborates with experienced professionals who want to add value through education and evaluation—without becoming product sellers or stepping outside their primary practice.

Designed for independent professionals. Not an employment role.