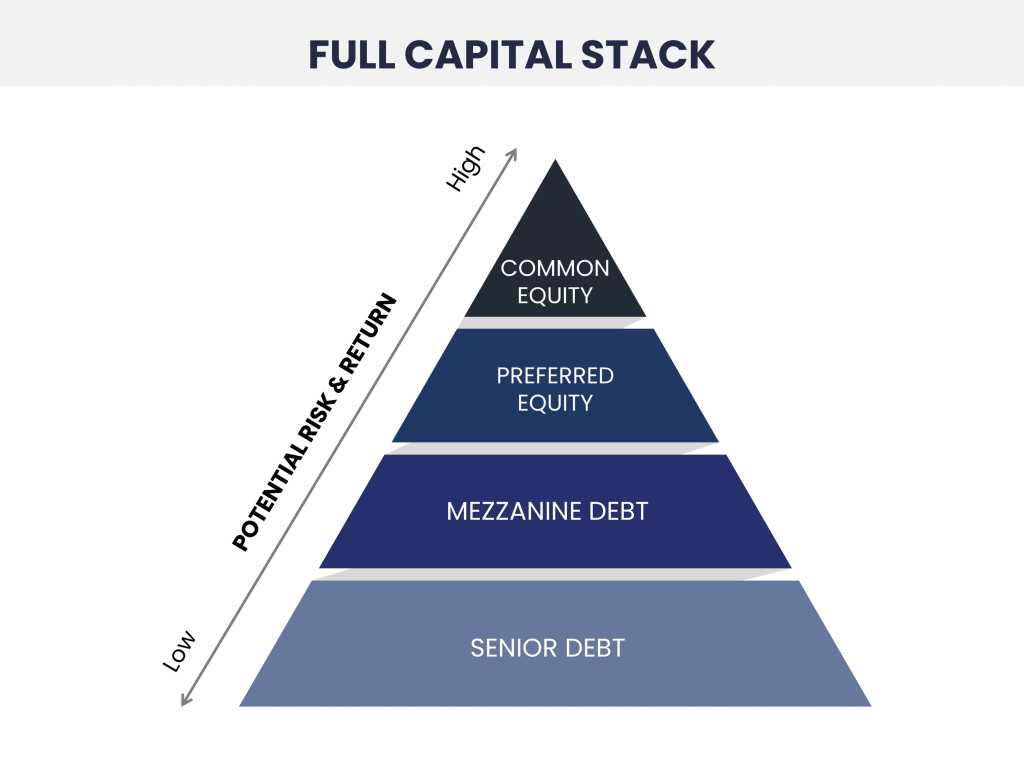

🔷 The Business Financial Stack (Advisory Framework)

The Business Financial Stack

How Smart Businesses Sequence Decisions

Most business owners are shown solutions in isolation.

The Business Financial Stack explains why sequence matters.

At AlanDavid.us, business decisions are approached as a layered system, not disconnected tactics.

🟦 Foundation: Business Clarity & Diagnostics

(Assess Before Acting)

Everything starts with understanding.

This foundational layer answers:

- Where is the business today?

- What problems actually exist?

- What opportunities are real — and which are not?

Tools & Concepts

- Business assessments

- Diagnostics (DREAMS Score)

- Cash flow awareness

- Risk tolerance evaluation

No product decisions should occur at this level.

🟩 Layer 2: Cash Flow & Capital Readiness

(Stability Before Expansion)

Once clarity exists, the next question is sustainability.

This layer evaluates:

- Revenue consistency

- Margin strength

- Timing needs

- Capital readiness

Tools & Concepts

- Working capital evaluation

- Revenue-based financing awareness

- Funding sequence planning

Capital is a tool — not a fix.

🟨 Layer 3: Tax Strategy Awareness

(Optimize What Already Exists)

Before adding complexity, businesses should optimize what they already generate.

This layer explores:

- R&D tax credit awareness

- Industry-specific incentives

- Entity and expense efficiency

Tools & Concepts

- Tax strategy education

- Specialist referrals

- Documentation readiness

Optimization often unlocks cash without borrowing.

🟧 Layer 4: Payroll Tax & Benefits Optimization

(Reduce Friction, Improve Efficiency)

Payroll is often the largest recurring expense.

This layer examines:

- Payroll tax exposure

- Benefits alignment

- Employer cost efficiency

- Workforce participation

Tools & Concepts

- Section 125-related concepts

- Benefits structuring awareness

- Compliant administration

Well-designed benefits reduce cost and improve retention.

🟥 Capstone: Strategic Growth Decisions

(Act With Context)

Only after the lower layers are aligned should businesses pursue major growth actions.

This layer includes:

- Expansion planning

- Scaling decisions

- Long-term capital strategy

- Advisory coordination

Growth is most effective when the stack below it is stable.

Why the Stack Matters

When businesses skip layers, they often experience:

- Over-leveraging

- Missed incentives

- Compliance risk

- Short-term fixes that create long-term problems

The Business Financial Stack ensures decisions are:

- Sequenced correctly

- Context-aware

- Aligned with business reality

How AlanDavid.us Uses the Stack

AlanDavid.us acts as the advisory layer across the entire stack.

We help businesses:

- Understand where they are in the stack

- Identify which layer needs attention

- Avoid premature decisions

- Connect to vetted specialists when appropriate

We do not sell products at the bottom of the stack —

we guide decisions through it.

Where to Start

For most businesses, the correct entry point is the foundation.

That’s why the recommended first step is a structured assessment that evaluates multiple layers at once.

👉 Start with the DREAMS Score

https://alandavid.us/dreams-score